Risk Manager

Support for Risk Managers

There is a delicate balancing act between these factors that needs to occur on a constant basis to remain profitable and avoid unforeseen credit calls.

A Risk Manager needs to have a strong grasp of:

- The composition of your customer book - its size, the type types of customers that comprise it, granular forecasted load, sales initiatives, and market factors that may impact future enrollments and drops, etc.

- Your costs – Energy-related costs, hedge value / mark-to-market, operational costs, etc.

- The tools you utilize to execute your risk management strategy - hedging techniques, hedge positions, available credit, etc.

Converged is here to support and inform your strategies to help realize the most profitability for your supply business.

We offer a suite of products that are specifically designed to assist Risk Managers on an hour-to hour basis.

ETRM

- Visualize your Mark-to-Market and Exposure Tracking.

- Simple Deal Capture.

- Intuitive Position Management.

Forecasting & Scheduling

- Scheduling, fully integrated with our Load Forecasting and ETRM products.

- Built in MAPE and Error Analysis.

- Forecasted Weather to improve accuracy.

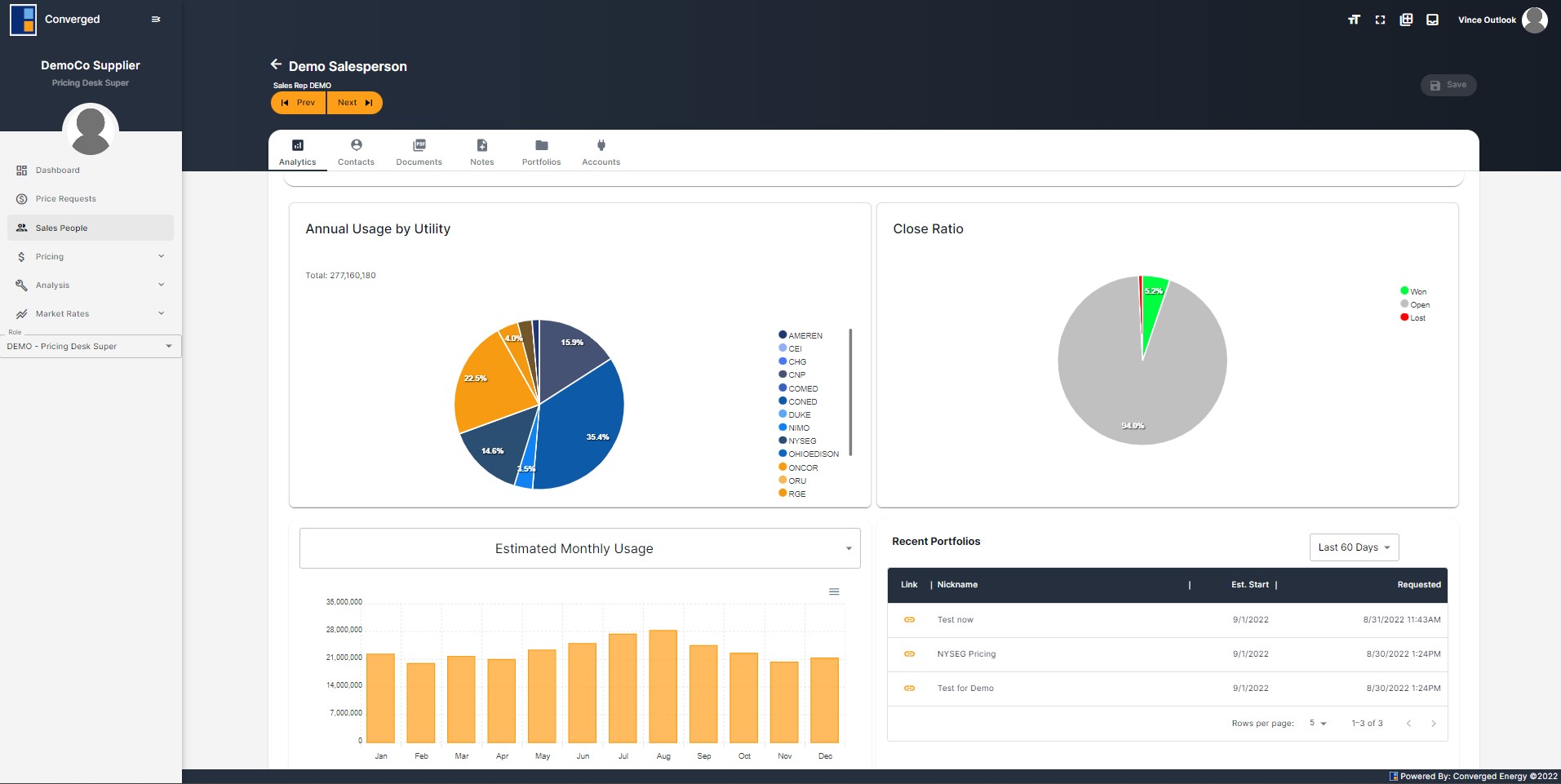

Pricing Desk

- Versatile multi-market, multi-commodity pricing.

- Work-flow management.

- Automated custom pricing using precise cost build ups.

- Matrix/rack pricing.